Security

Your Security. Our Priority.

We take your protection seriously. From encryption to fraud monitoring, Greater Kentucky Credit Union safeguards your information so you can bank with confidence.

Built on Trust.

Protected by Technology.

As a not-for-profit credit union, protecting your data is part of our promise to you. Our digital tools use advanced security protocols so you can bank confidently.

SECURITY

Proactive Safeguards for Every Account

Fraud and identity theft are on the rise, but you’re not alone. We continuously monitor systems and transactions to keep your information safe.

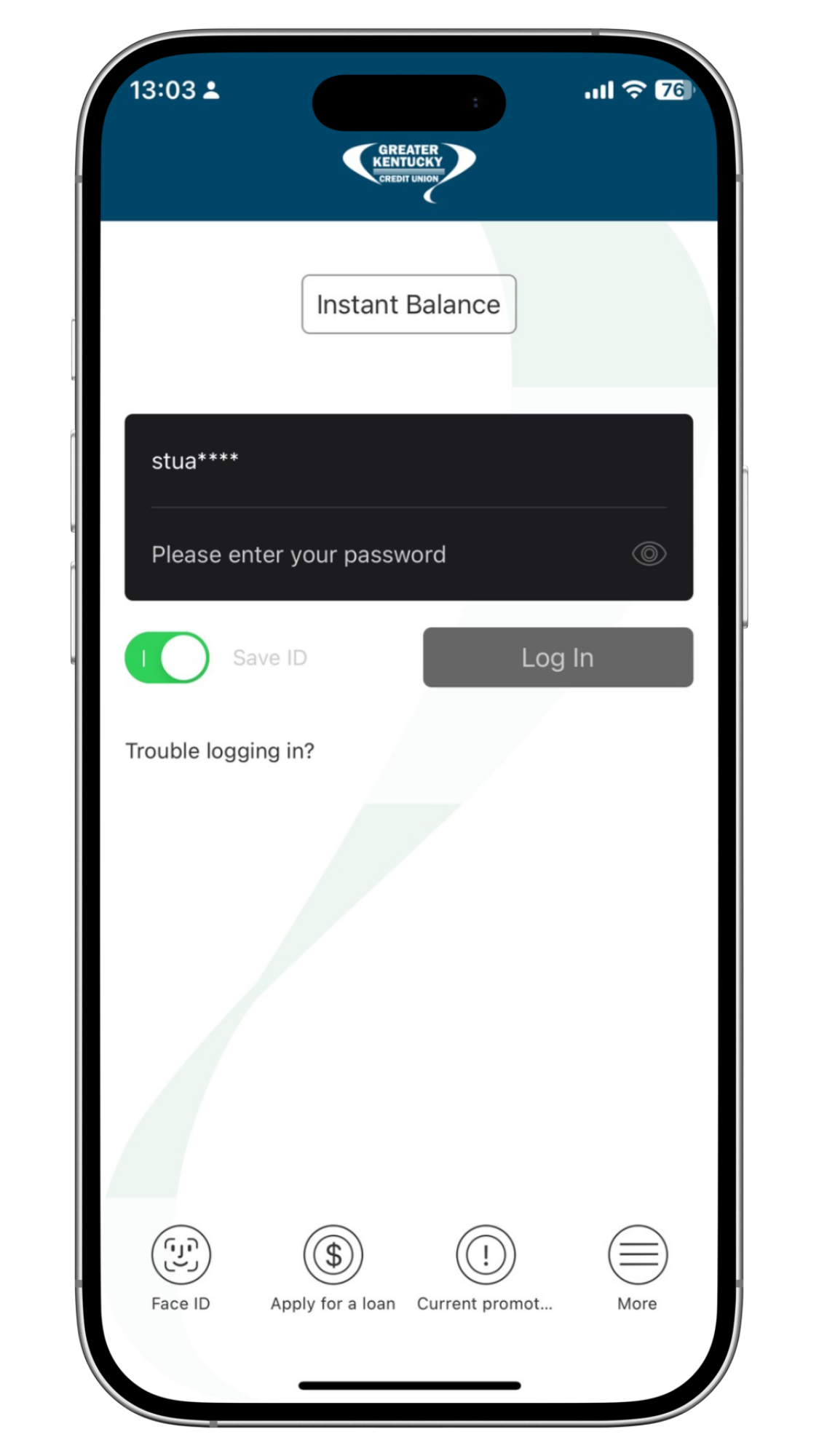

Multi-Factor

Authentication

Adds an extra layer of protection.

Encryption

All data is encrypted with industry-standard technology.

Fraud Monitoring & Alerts

We monitor transactions for suspicious activity 24/7.

Smart Habits for Safer Banking

- Never share passwords or verification codes.

- Use unique passwords for each account.

- Enable biometric or two-step login.

- Regularly review your account activity.

- Report suspicious messages immediately.

How to Get Started

(859) 231-9300

Talk or text with a Team Member

memberservice@gtkycu.com

Email a Team Member

-

How do I join Greater Kentucky Credit Union?

You can become a member online in just a few minutes or visit one of our Lexington or Versailles branches. Membership is open to anyone who lives, works, worships, or studies in Central Kentucky. Learn more.

-

How do I choose the right account for me?

Our team is here to help you find the perfect fit. Whether you’re looking for everyday checking, a high-yield savings account, or both, we’ll walk you through your options and make the process simple.

-

What happens after I open my account?

Once your account is active, you’ll enjoy better rates, fewer fees, and ongoing support from real local people who care about your success.

-

Can I manage my account online or on my phone?

Yes! GTKY offers full-service online and mobile banking with secure access to your balances, transfers, mobile deposits, bill pay, and more — available 24/7 from anywhere.

-

Are there fees to open or maintain my account?

Most GTKY checking and savings accounts come with no monthly fees or minimum balance requirements. We believe in transparency — no surprises, just better banking.